A Housing Market of Contradictions

The late summer housing market is defined by a key contradiction: mortgage rates have fallen to their lowest point since April, boosting buyer affordability, but this relief is a direct result of a stalling national labor market. July’s jobs report showed negligible growth after massive downward revisions for May and June, cooling the economy and pushing down borrowing costs. This dynamic creates a “stuck” market where improved affordability is met with economic uncertainty, eroding consumer confidence. As a result, forward-looking indicators like pending home sales show persistent declines, suggesting the market has yet to find momentum. In this August 2025 housing market update, we break down the latest mortgage rate shifts, buyer behavior, and forward-looking economic trends.

The Economic Backdrop: Cooling Inflation and a Stalling Jobs Engine

The economy is sending conflicting signals that are shaping the housing market. A significant slowdown in the labor market is pushing mortgage rates down, while stubborn inflation creates uncertainty about the Federal Reserve’s future policy.

The Labor Market's Warning Shot

The July jobs report revealed a significant economic slowdown. While the unemployment rate held at 4.2%, payrolls grew by a mere 73,000. More importantly, massive downward revisions for May and June erased a combined 258,000 previously reported jobs, showing the economy was stagnant through the spring. This lack of job creation, a key driver of housing demand, is amplified by a rise in long-term unemployment and a declining labor force participation rate. This weakness erodes consumer confidence, likely offsetting some of the benefits of lower mortgage rates.

Inflation's Stubborn Plateau

Despite the cooling labor market, inflation remains stubbornly above the Federal Reserve’s 2% target. The Producer Price Index showed that both headline and core inflation rose by 0.3%, which was much hotter than the 0.2% expected. It does appear that the tariffs are finally showing up in the data…but taking yesterday’s CPI and PPI reports together, we can derive that a lot of the cost is currently being absorbed along the supply chain. This puts the Fed in a difficult position: the weak job market calls for rate cuts, but high inflation calls for holding steady. This conflict creates uncertainty and suggests the current low-rate environment may be a temporary window for buyers.

The Rate Retreat: A Quantifiable Boost to Affordability

Mortgage rates have fallen significantly, providing a tangible boost to affordability. The average 30-year fixed rate dropped to 6.63% in early August, its lowest level since April. This retreat from May’s peak has a quantifiable impact: a buyer with a $3,000 monthly budget can now afford a home worth about $20,000 more. The market has responded immediately, with mortgage applications rising 2% week-over-week and up 18% from last year, demonstrating that pent-up demand is highly sensitive to rate changes.

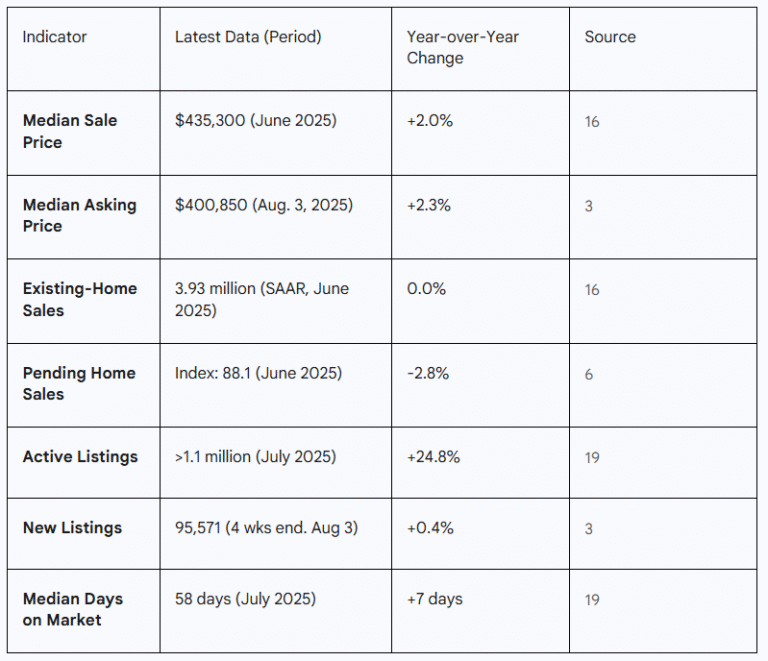

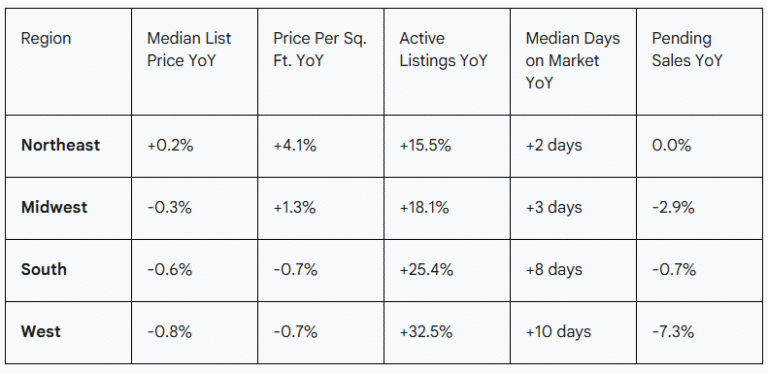

August 2025 Housing Market Update: Rebalancing Across Regions

The national housing market is clearly cooling and rebalancing, though the process is uneven across the country. It is critical to look at forward-looking data to understand the current trajectory.

Sales and Pricing: A Tale of Two Timelines

Recent housing data can be misleading. While June’s median sale price hit a record $435,300, this is a lagging indicator reflecting contracts signed in the spring. More current, forward-looking data shows a cooling market. The Pending Home Sales Index fell in June, signaling weaker sales ahead. Furthermore, median asking prices in early August saw one of their smallest year-over-year gains in two years, and list prices are already declining in the South and West, indicating that seller leverage is fading.

Inventory and Time on Market: More Choice, Less Urgency

Buyers now have more choices, as the inventory of homes for sale rose 24.8% year-over-year in July. However, this is a “passive” increase driven by cooling demand, not a flood of new sellers; new listings remain flat. Homes are simply sitting on the market longer—a median of 58 days in July, a full week longer than last year. This has allowed supply to accumulate to 3.9 months, moving closer to a balanced market. The market is characterized by stagnation, not a supply glut, making the rebalancing fragile.

August 2025 Housing Market Update Chart Sources Above:

Realtor.com (July 2025) for Price, Listings, and Days on Market; NAR (June 2025) for Pending Sales

The Human Element: Decoding Buyer and Seller Behavior

Underlying the market statistics are powerful demographic trends that explain the market’s resilience and its contradictions. A generational wealth transfer and a rebound in foreign investment are creating a strong price floor.

The Great Wealth Transfer: Boomers Take the Lead

A major generational shift is reshaping the market. Baby Boomers (ages 60-78) are now the largest group of homebuyers at 42%, overtaking Millennials. Leveraging decades of home equity, nearly half of Boomer buyers pay in all-cash, putting a floor under prices. This has made it difficult for younger, financing-dependent buyers, whose share of the market has fallen to a historic low of 24%. This dynamic explains the paradox of high prices coexisting with a severe affordability crisis.

The Return of the International Buyer

Adding to demand, foreign investment in U.S. homes surged 33% to $56 billion. Buyers from China, Canada, and Mexico lead the trend, concentrating their purchases in states like Florida, California, and Texas. Like Boomers, nearly half of these buyers pay in cash and purchase more expensive properties, providing another layer of price support in key markets.

Policy Watch: Washington's Bipartisan Push on Housing Supply

In a significant policy shift, Washington is showing rare bipartisan consensus to tackle the housing crisis by focusing on supply, not just demand. Two key bills lead this effort. The One Big Beautiful Bill Act boosts affordable housing construction by expanding tax credits and easing financing for developers. More comprehensively, the Renewing Opportunity in the American Dream (ROAD) to Housing Act of 2025 passed unanimously out of its Senate committee and aims to break down local barriers to construction by incentivizing zoning reform, streamlining permitting, and reducing regulatory burdens. This long-term strategy to build more homes could eventually ease the inventory shortage and create new opportunities across the housing industry.

Concluding Analysis & Forward Outlook

The housing market will remain “stuck” for the rest of 2025, caught between the opposing forces of lower rates and a weaker economy. While a major price crash is unlikely due to a price floor set by cash-heavy Boomer and international buyers, the market is clearly rebalancing. Transaction volume will stay low, and national home prices are forecast to remain flat or decline slightly.

For Homebuyers: Cautious Opportunity

Lower rates, more inventory, and greater negotiating power create the best buying conditions in over a year. However, economic uncertainty demands financial prudence.

For Home Sellers: Strategic Realism

The peak of seller power has passed. Price your home for today’s market, not last spring’s. Be prepared for longer days on market and negotiations.

Sources

- Mortgage Rates Continue to Decrease – GlobeNewswire, accessed August 12, 2025, https://www.globenewswire.com/news-release/2025/08/07/3129482/0/en/Mortgage-Rates-Continue-to-Decrease.html

- U.S. Mortgage Rates Dip to Four Month Low in Early August – The World Property Journal, accessed August 12, 2025, https://www.worldpropertyjournal.com/real-estate-news/united-states/washington-dc-real-estate-news/real-estate-news-freddie-mac-august-2025-primary-mortgage-market-survey-pmms-current-mortgage-rates-today-sam-khater-2025-mortgage-data-14523.php

- Buyers, Take Note: Mortgage Rates Are Falling, Home-Price Growth …, accessed August 12, 2025, https://www.redfin.com/news/housing-market-update-mortgage-rates-fall-price-growth-slow/

- Employment Situation Summary – 2025 M07 Results, accessed August 12, 2025, https://www.bls.gov/news.release/empsit.nr0.htm

- The Employment Situation – July 2025 – Bureau of Labor Statistics, accessed August 12, 2025, https://www.bls.gov/news.release/pdf/empsit.pdf

- Pending Home Sales Drop in June as Buyers Struggle With Affordability – Realtor.com, accessed August 12, 2025, https://www.realtor.com/news/real-estate-news/pending-home-sales-data-nar-june-2025/

- NAR Pending Home Sales Report Shows 0.8% Decrease in June – GlobeNewswire, accessed August 12, 2025, https://www.globenewswire.com/news-release/2025/07/30/3124189/0/en/NAR-Pending-Home-Sales-Report-Shows-0-8-Decrease-in-June.html

- Pending Home Sales Index July 2025 – Team Price Real Estate, accessed August 12, 2025, https://teamprice.com/pending-home-sales-index

- Employment Situation for August 2025 – Morisey-Dart Group, accessed August 12, 2025, https://www.morisey-dart.com/2025/08/01/employment-situation-for-august-2025/

- United States Inflation Rate – Trading Economics, accessed August 12, 2025, https://tradingeconomics.com/united-states/inflation-cpi

- U.S. Bureau of Labor Statistics, accessed August 12, 2025, https://www.bls.gov/

- Inflation Nowcasting – Federal Reserve Bank of Cleveland, accessed August 12, 2025, https://www.clevelandfed.org/indicators-and-data/inflation-nowcasting

- US markets today: Wall Street holds near record highs ahead of inflation data; Federal Reserve cautious on rate cuts as stagflation fears rise, accessed August 12, 2025, https://timesofindia.indiatimes.com/business/international-business/us-markets-today-wall-street-holds-near-record-highs-ahead-of-inflation-data-federal-reserve-divided-over-rate-cuts-as-stagflation-fears-rise/articleshow/123238981.cms

- Mortgage Rates Continue to Decrease | Freddie Mac, accessed August 12, 2025, https://freddiemac.gcs-web.com/news-releases/news-release-details/mortgage-rates-continue-decrease-7

- Freddie Mac: Borrowing rates continuing to slide – Mortgage Professional, accessed August 12, 2025, https://www.mpamag.com/us/mortgage-industry/market-updates/freddie-mac-borrowing-rates-continuing-to-slide/545554

- NAR Existing-Home Sales Report Shows 2.7% Decrease in June, accessed August 12, 2025, https://www.nar.realtor/newsroom/nar-existing-home-sales-report-shows-2-7-decrease-in-june

- NAR: Existing-home sales price hits all time high in June – Atlanta Agent Magazine, accessed August 12, 2025, https://atlantaagentmagazine.com/2025/07/23/nar-existing-home-sales-2/

- NAR Existing-Home Sales Report Shows 2.7% Decrease in June – GlobeNewswire, accessed August 12, 2025, https://www.globenewswire.com/news-release/2025/07/23/3120394/0/en/NAR-Existing-Home-Sales-Report-Shows-2-7-Decrease-in-June.html

- July 2025 Housing Market Trends Report—Realtor.com Research, accessed August 12, 2025, https://www.realtor.com/research/july-2025-data/

- Four Takeaways from NAR’s New Generational Trends Report | Old …, accessed August 12, 2025, https://www.oldrepublictitle.com/blog/four-takeaways-from-nar-report-2025/

- 4 Key Takeaways: 2025 Home Buyers and Sellers Generational Trends Report – Virginia REALTORS®, accessed August 12, 2025, https://virginiarealtors.org/2025/04/09/4-key-takeaways-2025-homebuyers-and-sellers-generational-trends-report/

- 10 Highlights From NAR’s 2025 Home Buyers and Sellers Generational Trends Report, accessed August 12, 2025, https://www.ryanrobertsrealtor.com/2025/04/28578/

- What the 2025 NAR Report Really Tells Us About Foreign Buyers | Yuval Golan – Waltz, accessed August 12, 2025, https://www.getwaltz.com/blog-posts/nar-report-takeaways-foreign-buyers

- Foreign Buyer Activity Rebounds—and Agents Are Taking Notice, accessed August 12, 2025, https://www.nar.realtor/magazine/real-estate-news/foreign-buyer-activity-rebounds-and-agents-are-taking-notice

- 2025 International Buyers in U.S. Real Estate: What the New NAR Report Means for South Florida, accessed August 12, 2025, https://www.reallistingagent.com/blog/2025/8/7/2025-international-buyers-in-us-real-estate-what-the-new-nar-report-means-for-south-florida

- International Transactions in U.S. Residential Real Estate, accessed August 12, 2025, https://www.nar.realtor/research-and-statistics/research-reports/international-transactions-in-u-s-residential-real-estate

- Federal Housing Policy Update During California’s Summer Recess …, accessed August 12, 2025, https://californiacouncil.org/news/federal-housing-policy-update-during-californias-summer-recess

- The One Big Beautiful Bill Encourages Economic Development – Senate Finance Committee, accessed August 12, 2025, https://www.finance.senate.gov/chairmans-news/the-one-big-beautiful-bill-encourages-economic-development

- U.S. Senate Committee Advances Major Housing Bill: How It Would Impact Cities, accessed August 12, 2025, https://www.lmc.org/news-publications/news/all/u-s-senate-committee-advances-major-housing-bill-how-it-would-impact-cities/

- Banking Committee Passes Bipartisan ROAD to Housing Act, accessed August 12, 2025, https://nlihc.org/resource/banking-committee-passes-bipartisan-road-housing-act

- The 100-year wait: The federal government returns to land use policy in full force with the introduction of sweeping bipartisan housing package, accessed August 12, 2025, https://www.smartgrowthamerica.org/knowledge-hub/news/the-100-year-wait-the-federal-government-returns-to-land-use-policy-in-full-force-with-the-introduction-of-sweeping-bipartisan-housing-package/

- What New ROAD to Housing Act Means for Homeowners – Newsweek, accessed August 12, 2025, https://www.newsweek.com/what-new-road-housing-act-means-homeowners-2106128

- What’s in the ROAD to Housing Act of 2025? | Bipartisan Policy Center, accessed August 12, 2025, https://bipartisanpolicy.org/explainer/whats-in-the-road-to-housing-act-of-2025/

- United States Housing Market & Prices – Redfin, accessed August 12, 2025, https://www.redfin.com/us-housing-market